Embarking on the entrepreneurial journey involves navigating through a haze of uncertainties, especially when it comes to financial projections. Crafting a financial forecast often feels akin to looking through a crystal ball, albeit with a structured methodology.

While everyone acknowledges the speculative nature of projections (ie SWAGs), portraying rigor and a deep understanding of associated costs, alongside a realistic sense of market demand, is crucial to developing Founder trust.

This exercise is less about accuracy and more about showcasing a logical, well-thought-out financial pathway that stands up to scrutiny - emphasizing the Founder’s domain expertise and clear(ish) vision.

Well structured and thoughtful Projections are meant to tell the story as well as triggering the pattern recognition of the Investor.

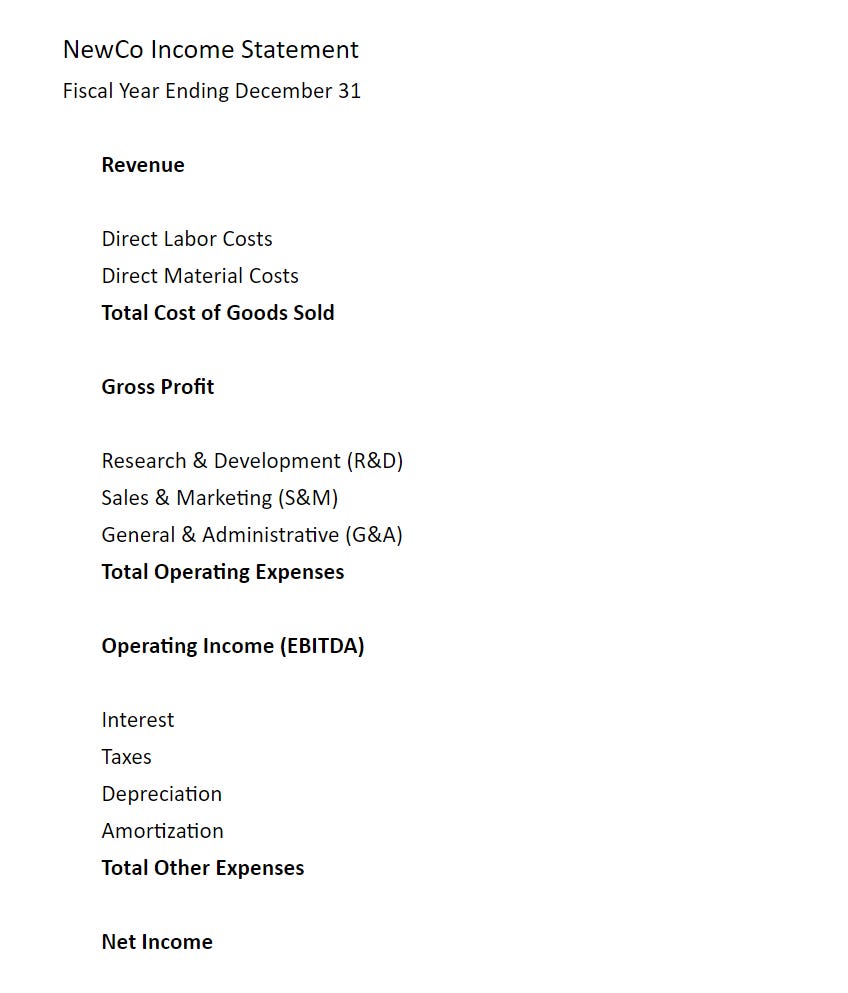

Here’s a simple example of the Income Statement and below are some pointers on how to navigate this challenging yet crucial task.

Bottom-Up Revenue Forecasting: A Realistic Lens

Unlike top-down forecasting that starts with the total market size and narrows down, bottom-up forecasting begins with your startup's capabilities and expands outward. It's a meticulous approach that demands a deep dive into unit economics, operational capacities, and market demand.

Unit Economics: Understand the cost to deliver your service and the price at which it will be sold. Analyzing unit economics is foundational to determining your business model's viability.

Market Demand: Conduct thorough market research to gauge the demand for your service. Engage in customer surveys, and analyze competitor pricing to understand what customers are willing to pay.

Operational Capacities: Assess your operational capacities to deliver services. This involves scrutinizing your production, distribution, and sales channels. Embrace current market reality - copy, then innovate.

Example: Dropbox’s Bottom-Up Approach

Dropbox, in its early stages, employed a bottom-up approach by focusing on individual and small business users before expanding to larger organizations. This approach allowed them to build a realistic revenue model based on actual user growth and adoption rates.

Understanding Your Costs: The Foundation of Projections

At the heart of any financial projection lies a thorough understanding of your cost structure. Knowing the cost of delivering your service is fundamental.

Fixed Costs: Identify all fixed costs such as rent, salaries, and utilities that will recur irrespective of your operations. These are typically G&A (General & Administrative), while some are Department specific such as R&D (Research & Development) or S&M (Sales & Marketing).

Variable Costs: Understand the variable costs associated with delivering your service. This includes costs that fluctuate with your level of operation and are typically COS / COGS (Cost of Sales / Cost of Goods Sold)

Embracing Conservatism: The Wise Path

When crafting financial projections, adopting a conservative approach is wise. Overestimating expenses and underestimating revenues may seem counterintuitive, but it reflects prudence and readiness for unexpected challenges.

Expense Projections: Account for unforeseen expenses by adding a contingency buffer. This demonstrates a realistic understanding of startup challenges. Everything seems to cost more and take longer than projected.

Revenue Projections: Be conservative in estimating sales volumes and pricing. Investors often look favorably upon realistic revenue projections as it reflects a grounded understanding of the market and Team’s ability to scale up.

Example: Buffer’s Transparent Approach

Buffer, known for its transparency, openly shared its financial projections and actuals. Their conservative approach in revenue projections showcased prudency, which built trust among investors and the wider community.

Stress-Testing: Preparing for Scrutiny

Conducting a stress-test of your financial projections against various scenarios isn’t merely a theoretical exercise but a practical tool to prepare for future uncertainties.

Scenario Analysis: Create worst, expected, and best-case scenarios to understand the range of potential outcomes. My personal preference is not to share these scenarios, but to have completed the exercise internally to better understand the leverage in the model. Stand by the projections that you feel are reasonable and defensible - my advice is to be firm with defending your assumptions, otherwise the review of projections with an Investor can become an intellectual exercise where they think they are helping you versus making an investment decision.

Sensitivity Analysis: Evaluate how changes in key assumptions affect your projections. This includes varying price points, costs, and sales volumes - identify key financial assumptions that have the greatest impact on the numbers. Having a deep understanding of where a small change in the underlying assumptions have an outsized impact on Revenue and EBITDA. Maybe the onboarding process starts out human intensive and rapidly becomes automated - something discussed in the roadmap and reiterated during presenting the financials.

Ensuring Consistency and Transparency: Building Credibility

Ensure consistency in your assumptions and be transparent about the methodologies used in deriving your projections. This builds credibility and allows potential investors to follow your logic.

Leveraging Tools and Expertise: Navigating the Complexity

Financial projections can be complex; leveraging tools like financial modeling software or engaging financial experts can provide valuable insights and improve the accuracy of your forecasts. While many of the tools are limited in scope and flexibility, they probably get you 80% of the way there and provide recognizable aesthetics and structure. Experts bring a wealth of experience in identifying potential pitfalls and ensuring your projections are well-grounded. Remember that the Projections are a way to trigger pattern recognition in an Investor such that they see something similar to what they saw in a past successful opportunity.

In Conclusion

Crafting financial projections is a blend of art and science. It's about balancing optimism with realism, ambition with pragmatism. A well-structured, conservative, and bottom-up driven financial forecast not only stands up to investor scrutiny but also serves as a pragmatic roadmap guiding your startup through the early-stage challenges towards a sustainable revenue-generating future.